Are there disadvantages to quick-change drill and driver bits? - drill bit quick connect

Easily access valuable industry resources now with full access to the digital edition of Canadian Fabricating & Welding.

Combining these acreage the pro forma company has current net production of about 7.9 billion cubic feet equivalent per day (Bcfepd), as per a statement.

Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis.

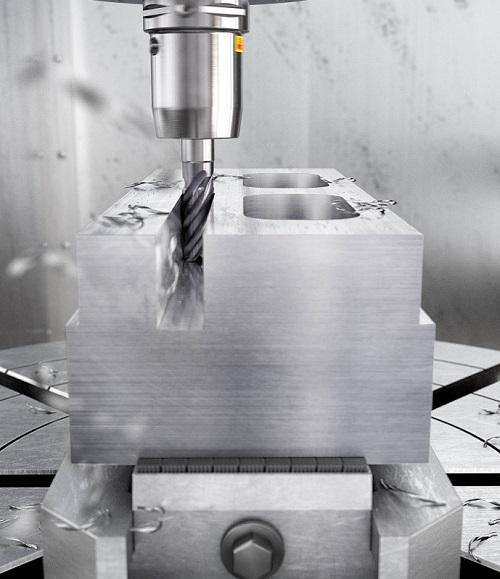

The new grades enable a 30 per cent increase in cutting speed recommendations for the primary ISO P and ISO M application areas, as well as secondary ISO K and ISO S materials, thanks to their optimized flute shape, which offers effective chip evacuation. The grades designed for stainless steel machining come in two variants: one with internal coolant for improved temperature control and chip flow, and one without internal coolant.

"It aligns with our long-standing framework for successful consolidation and is one of the few transactions in the sector where one plus one should turn out to be much greater than two," managing partner Mark Viviano said on Thursday. The firm has a little over 2% stake in each company.

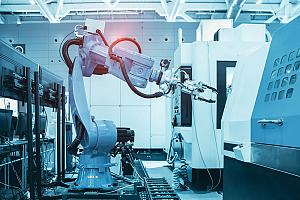

Introducing ISCAR's Latest Products for 2024: QUICK-T-LOCK A Revolutionary 3 Cutting Edged Insert with SAFE-T-LOCK for Enhanced Multi Directional Performance.

U.S. natural gas prices are expected to tick higher from a jump in exports, analysts have said, after a gloomy 2023 due to record production, flat consumption, and rising natural gas inventories.

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Meanwhile, activist investment firm Kimmeridge Energy Management, which pushed Chesapeake to move away from oil drilling, said it was "highly supportive of the merger".

Chesapeake Energy said on Thursday it would buy smaller rival Southwestern Energy Southwestern Energy in an all-stock transaction valued at $7.4 billion, a deal that would enable the second-largest U.S. natural gas producer to take the top spot.

The Southwestern bid is the biggest in Chesapeake's efforts to add heft to a pivot to natural gas assets since emerging from bankruptcy in 2021. Last year, it beefed up its position in the gas-rich shale plays of the U.S. northeast with its $2.5 billion buyout of Chief E&D.

Chesapeake has offered $6.69 per Southwestern share held, representing a discount of about 3% to the stock's last close, according to Reuters calculation.

The deal would also be a reversal of sorts. Southwestern had acquired some acreage in West Virginia and Pennsylvania from Chesapeake for $5.4 billion in 2014.

Southwestern's shares fell 3% in premarket trading. The stock has gained about 2% since Reuters exclusively reported in mid-October on the deal talks. Shares of Chesapeake were up 2.5% before the bell.

The deal is expected to close in the second quarter. Chesapeake shareholders will own about 60% of the combined company and Southwestern investors the rest.

If the merger goes through, the combined firm would overtake EQT Corp as the largest independent natural gas-focused exploration and production company in the U.S. by market value and output

The standard assortment offers diameters from 2 to 25 mm, a 2xD depth of cut, 4 to 5 teeth and a ramping angle of 5 or 7 degrees. Tailor Made options are available within the Customized Solutions range.

The move extends a recent spate of multi-billion deals in the U.S. energy sector including Exxon Mobil's $60 billion Pioneer Natural Resources offer and Chevron's $53 billion agreement for Hess, as companies seek lucrative acreage to rebuild depleting assets.

"Not only do we think investors will reward CHK shares in the near-term due to its size/scale, we remain optimistic that the proforma company will see multiple expansion," said analysts at Truist Securities in a note.

The 62% dive in the commodity price last year also weighed on profits at natural gas producers. Southwestern reported third-quarter net income that was a tenth of its year-earlier earnings.

Sandvik Coromant introduces the CoroMill Plura HD for heavy-duty applications up to 2xD in steel and stainless steel (ISO P and ISO M). The new Zertivo 2.0-coated grade further improves tool life, process security, and productivity, according to the company.

18581906093

18581906093