Carbide burrs | Accessories for die grinders - die grinder bits for steel

CNC machines operate continuously and can run multiple tasks without manual intervention, leading to higher productivity. Automated tool changes, faster cutting speeds, and reduced setup times contribute to increased efficiency in production. CNC technology enables the production of intricate and complex parts that might be challenging or impossible to manufacture using conventional methods. This capability is especially crucial in industries like aerospace, automotive, and medical devices. CNC machines are often integrated with Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software. This integration allows for seamless translation of design specifications into machine instructions, optimizing the manufacturing process. Manufacturers are developing new products. For instance, in April 2023, Okuma Corporation developed the LB3000 EX? CNC lathe and MB-46V ? vertical machining center, which are world-class Green-Smart Machines with high precision and energy-saving performance.

[262 Pages Report] The global machine tools market size was valued at USD 78.6 billion in 2023 and is expected to reach USD billion by 2030, at a CAGR of 4.2% during the forecast period 2023-2030. The rising demand for manufactured goods across diverse industries catalyzes the growth and evolution of the global machine tools market. This demand fuels the development of more advanced, efficient, and specialized machine tools capable of meeting the intricate and diverse needs of the modern manufacturing process. As the demand for precision, customization, and high-volume production continues to surge, the machine tools market is propelled forward, fostering innovation and technological advancements.

The bottom-up approach was used to estimate and validate the size of the global machine tools market. In this approach, the machine tools sales statistics were considered at the country level.

The key trends impacting the growth of the machine tools market are smart and Connected Machines, Additive Manufacturing, Flexibility and Customization, and Implementation of AL and ML.

China, Japan, and South Korea lead the Asia Pacific global machine tools market. The region is considered significant in the growth of the global market, both in production and sales. China is the largest machine tools producer and user globally, dominating the market in the region. The aging population in China and Japan has resulted in rising labor costs, leading to the growing adoption of automation. The increasing population is also attracting companies to invest in the Asia Pacific. Some of the most prominent players in the market space are present, such as DMG MORI (Japan) and Okuma Corporation (Japan). Makino Milling Machine Co., Ltd. (Japan), JTEKT Corporation (Japan), DN SOLUTIONS (South Korea), and others are other major factors driving the market in this region. Manufacturers in the Asia Pacific region are investing in building manufacturing plants. For instance, in June 2023, Nidec Machine Tool launched a new cutting tool factory in India to meet the growing demand for automotive and related components by increasing the production capacity by 1.5 times. Such developments are expected to propel the market growth.

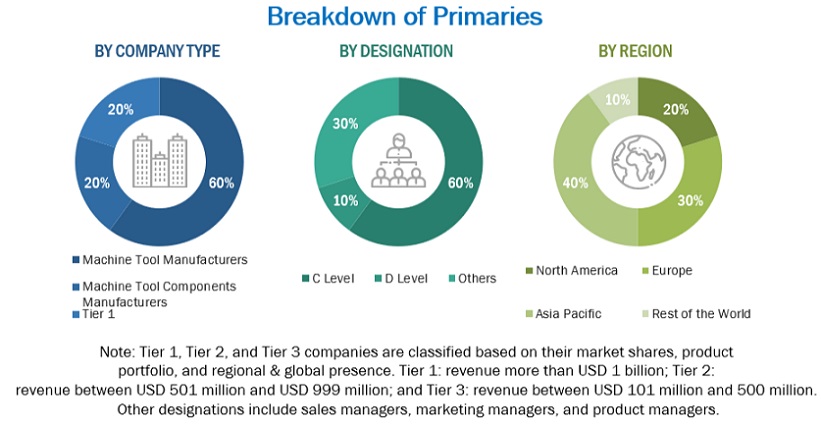

Extensive primary research was conducted after acquiring an understanding of the global machine tools market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, R&D centers, and machine tools manufacturers) and supply (machine tools manufacturers, machine tools component manufacturers, and raw material suppliers) sides across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. The experts involved in primary interviews are 24% from the demand side, and 76% from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in the report.

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Additionally, CNC machines can be tailored to meet the needs and specifications of final customers. The applications for which CNC machines are intended vary in their requirements. In addition, CNC machines need to be updated, when the manufacturing process or products undergo significant modifications that result in elevated expenses. These high costs associated with the overall operation of CNC machines are the key factors considered in making purchase decisions. They are expected to hinder the adoption of CNC machines, especially across cost-sensitive regions and industries. Therefore, high installation and maintenance costs about machine tools are expected to prove to be a restraining factor for the growth of the global machine tools market.

There is no single dominant protocol or interface for machine tool communication. Instead, many options exist, including MTConnect, OPC UA, Siemens Sinumerik, Fanuc, and Heidenhain. This variety creates incompatibility issues, making it difficult for different machines and devices to talk to each other. Moreover, integrating new machines and devices into existing systems becomes a complex and time-consuming task due to the lack of standardization. This hinders the potential for creating smart factories and interconnected production lines.

CNC machine tools have the largest market share in the global machine tools market. Consumers increasingly demand customized products, which require flexible and agile manufacturing processes. CNC machines can be easily programmed to produce different product variations, making them ideal for meeting customization demands.

The machine tools market is dominated by established players such as Makino Inc. (Japan), JTEKT Corporation (Japan), Okuma Corporation (Japan), DMG MORI Co., Ltd. (Japan), DN Solutions (South Korea), and others. These companies manufacture machine tools and develop new technologies. These companies have set up R&D facilities and offer best-in-class products to their customers.

The global machine tools market responds to these demands by continually innovating and developing cutting-edge technologies. Manufacturers invest in research and development to create more precise, efficient, and adaptable tools capable of meeting the evolving needs of modern manufacturing. The focus on precision and efficiency remains a key driver, guiding the market towards advancements that push the boundaries of what is achievable in manufacturing processes.

Asia Pacific will be the fastest-growing machine tools market. The Asia Pacific region boasts a strong and rapidly growing manufacturing sector, particularly in countries such as China, India, and Vietnam. This sector encompasses various industries, including automotive, electronics, aerospace, and consumer goods, all of which rely heavily on machine tools for production.

The cost of buying advanced machine tools is high. This is a major factor impeding the global machine tool market's expansion. Depending on the brand and model, brand-new CNC lathes and routers can cost thousands of dollars. The expenses incurred by organizations that use CNC machines are subsequently raised by these investments, which also include shipping, installation, operating, and maintenance expenditures. CNC machines have a large weight range of 100 pounds to several tons. Purchase agreements typically cover transportation expenses; if not, customers may have to pay hundreds of dollars in additional fees.

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Depending on the machining operation, these machines use various cutting tools, including end mills, drills, lathes, and specialized tools. These tools are attached to the machine's tool holder and can be automatically changed during operations. There are various types of machines, such as milling machines, turning machines, electrical discharge machining (EDM) machines, grinding machines, and drilling machines. These machines benefit industries with increased precision, productivity, versatility, and efficiency. Manufacturers are also developing models with advanced features. For instance, in June 2023, Makino Milling Machine Co., Ltd. introduced a horizontal machining center a91nx. This horizontal machining center’s spindle lineup can handle various work materials, such as cast iron and aluminum. Such developments will further drive the demand for CNC machine tools during the forecast period.

Moreover, all the leading players in the global machine tools market are generating the majority of their revenues from the Asian region only. China, Japan, India, and South Korea have a large customer base. These nations are home to companies prioritizing research and development, further contributing to the industry’s potential. Additionally, this region’s demand for advanced machine tools in sectors such as automotive, aerospace, energy, semiconductors, and medical industries is notably high.

Markets and Markets research pvt ltd. (Feb, 2024 ). Global Machine Tools Market by Product Type (Milling Machines, Turning Machines, Grinding Machines, EDM), Automation Type (CNC and Conventional), End-User Industry (Automotive, Capital Goods), Sales Channel and Region - Global Forecast to 2030 MarketsandMarkets. Retrieved Oct 12, 2024, from https://www.marketsandmarkets.com/Market-Reports/machine-tools-market-168345068.html

Precision in manufacturing directly correlates with minimized waste and rework. High-precision machine tools ensure that parts are manufactured accurately the first time, reducing material wastage and the need for costly reworking processes. Integrating digital technologies and data-driven solutions in machine tools also allows for predictive maintenance, real-time monitoring, and adaptive control. This integration enhances precision and efficiency while minimizing downtime.

Submit your quotation by clicking on the link below. Please provide as much information as you can with any appropriate drawings that you may have. We will recieve it almost instantly and be in contact with you ASAP.

The absence of standardization in industrial communication protocols and interfaces for machine tools presents a significant challenge, but the ongoing efforts towards establishing common ground promise a brighter future for the industry. By embracing open standards and collaborative approaches, the machine tool sector can unlock new levels of efficiency, innovation, and competitiveness in the age of Industry 4.0.

Machine tools are stationary, power-driven equipment used to shape or form parts made of metals, alloys, and composites by cutting, grinding, boring, shearing, etc. These machine tools include milling, drilling, turning, grinding, and electrical discharge machines. CNC machine tools are computer-controlled machines, which provide better precision and control than conventional machine tools.

Industries such as automotive, aerospace, electronics, and healthcare sectors have stringent demands for high-precision components. Machine tools need to meet these requirements to ensure the production of intricate parts with minimal error margins. As product designs become more complex and sophisticated, the need for tight tolerances and impeccable quality standards rises. Machine tools with cutting-edge technologies, such as computer numerical control (CNC), provide the precision necessary to meet these exact specifications.

The adoption of CNC technology in machine tools continues to grow as manufacturers seek ways to improve precision, increase productivity, and stay competitive in a rapidly evolving market. The ongoing advancements in CNC technology will likely drive further innovation and expansion of its applications in the manufacturing industry.

The top-down approach was used to estimate and validate the size of the global machine tools market by automation, product type, sales channel, and end user industry. To derive the market size by product type, the global market size in terms of value was divided into milling machines, drilling machines, turning machines, grinding machines, and electrical discharge machines using the penetration and percentage split, respectively. The global market was further segmented at the regional level. A similar approach was used to derive the market size of automation, sales channel, and end user industry segments in terms of value.

This research report categorizes the global machine tools market based on product type, automation, sales channel, end-user industry and region.

The adoption of computer numerical control (CNC) technology in machine tools has been transformative in the manufacturing industry. CNC technology has revolutionized machining processes by offering precision, efficiency, and automation. CNC technology allows for incredibly precise and accurate machining operations. Machines controlled by computer programs ensure consistent quality, reducing errors and improving the overall precision of manufactured parts.

The countries covered in the report for the machine tools market are China, Japan, South Korea, India, Thailand, Taiwan, Vietnam, Malaysia, and the Rest of APAC. .

We will customize the research for you, in case the report listed above does not meet with your exact requirements. Our custom research will comprehensively cover the business information you require to help you arrive at strategic and profitable business decisions.

The milling machine segment is expected to lead the global machine tools market during the forecast period. Industries like aerospace, medical devices, and electronics rely heavily on components with tolerances measured in microns. Traditional machining methods often struggle to achieve such precision, but milling machines excel in this area. Their ability to deliver intricate details and consistently high quality makes them the go-to choice for manufacturers in these demanding sectors. Also, the growing focus on sustainability is shaping the milling machine market. Manufacturers seek machines offering features like reduced energy consumption and minimized waste generation. Modern milling machines are increasingly designed with these factors, incorporating features like optimized cutting paths and eco-friendly coolants, making them more attractive in a sustainability-conscious world. In Addition to this, Manufacturers are developing new products. For instance, in 2023 in India, Lakshmi Machine Works Limited (India) launched the JD I vertical milling machine that is designed for heavy-duty milling with a maximum travel of 1250 x 800 x 760 mm and a table load capacity of 1,500 kg. Such product developments will help various sectors, including manufacturing, automotive and transportation, capital goods, and energy and power, to increase their productivity and accuracy.

This research study involved the use of extensive secondary sources, directories, and databases, which were used to classify and gather the facts and figures useful for the technical, market-oriented, and commercial study of the global machine tools market. Primary interviews were conducted to obtain and verify critical inputs on qualitative and quantitative information and to assess the prospects of the machine tools industry. Primary sources mainly included experts from the core and related industries, suppliers, manufacturers, distributors, technology developers, and organizations related to various segments of this industry’s value chain. Detailed interviews were conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

The machine tools market is dominated by established players such as Makino Inc. (Japan), JTEKT Corporation (Japan), Okuma Corporation (Japan), DMG MORI Co., Ltd. (Japan), DN Solutions (South Korea), and others. These companies machine tools and develop new technologies. These companies have set up R&D facilities and offer best-in-class products to their customers.

The incompatibility between protocols restricts data exchange and limits the ability to collect and analyze valuable production data. This impedes process optimization and informed decision-making. The lack of standardization also necessitates custom adapters and gateways to bridge the communication gap between different machines. This adds to the overall cost and complexity of implementing industrial automation solutions.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primary interviews. This, along with the in-house subject matter experts’ opinions, led to the findings delineated in the rest of this report.

Makino Inc. (Japan), JTEKT Corporation (Japan), Okuma Corporation (Japan), DMG MORI Co., Ltd. (Japan), DN Solutions (South Korea) and others. A total of 29 major company profiles were covered and provided.

18581906093

18581906093