Better, Faster, Smarter - long reach carbide end mills

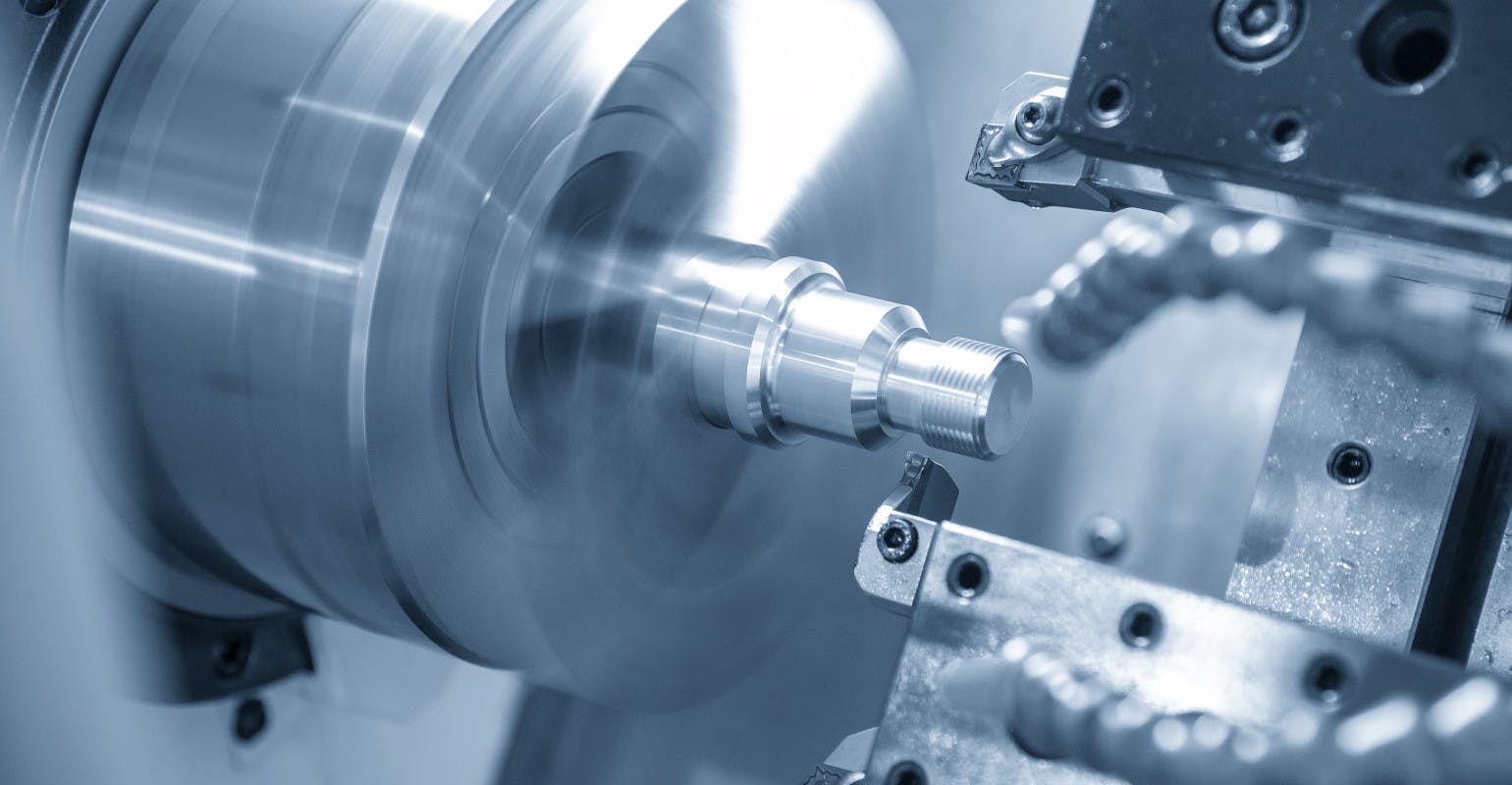

High-feed machining (HFM) employs a large radial width of cut—greater than 50 percent is typical—together with a small axial depth-of-cut and, as its name implies, very high feed rates.

“While 2024 started on a positive note, we have seen significant stagnation in several markets utilizing cutting tools,” offered Steve Boyer, president of USCTI. “Aerospace has seen many challenges this year, and while we expect to see that market improve in 2025, it has impacted growth for 2024. Modest gains have been realized with orders for the automotive markets but have not fully offset some of the slides attributable to the aerospace industry.

In recent interviews, these experts explained some of the ways machinists can use the new and developing technologies to produce more chips—and bolster the bottom line for their businesses.

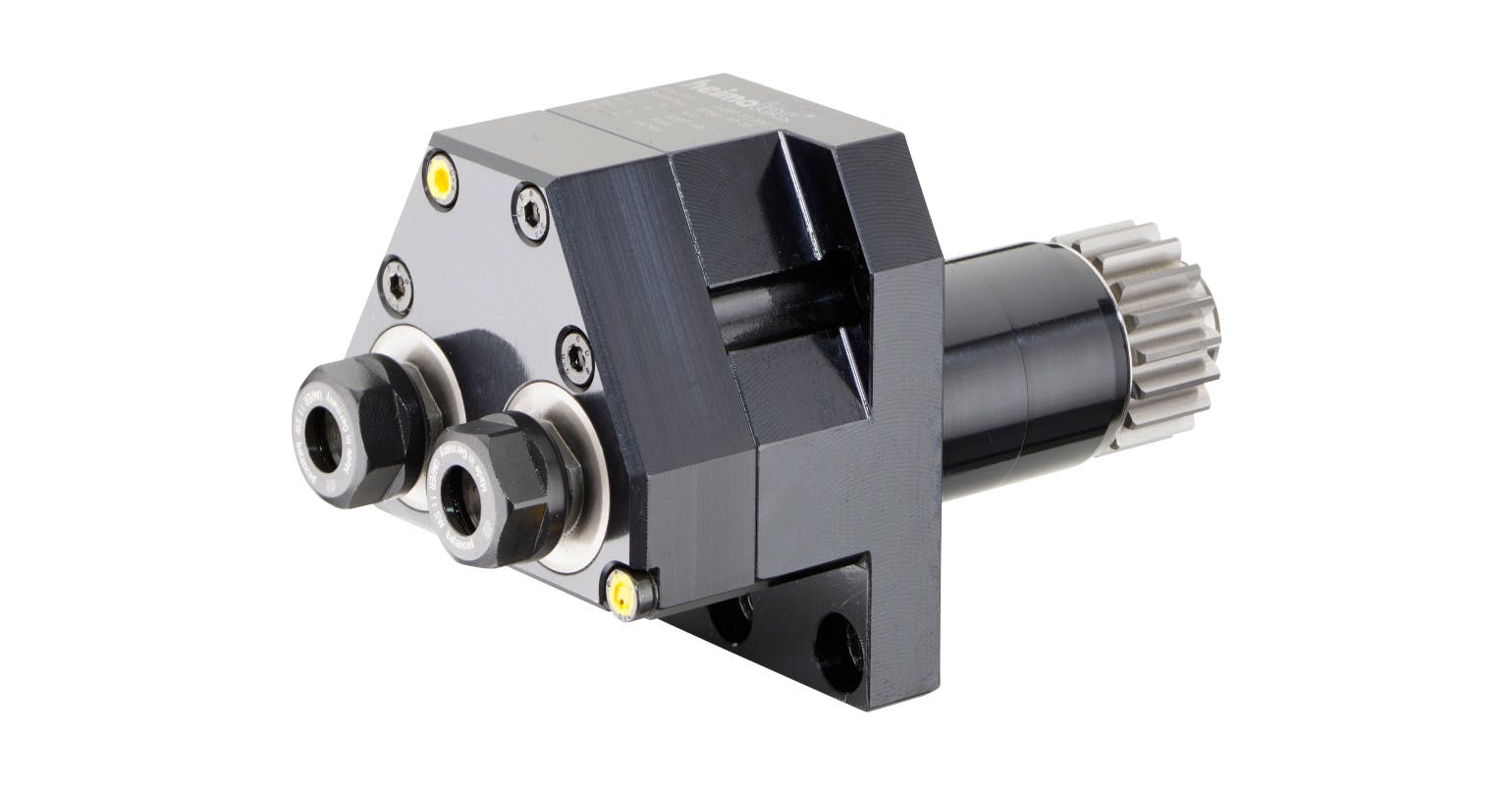

Different tool geometries and coatings are often optimized for these different machining techniques. OSG, Kennametal, and Kyocera SGS each offer a broad selection of solid-carbide, modular, and indexable cutters, many of them designed specifically for one or more of the toolpaths just described.

Then, the question becomes the best ways to combine each of these different milling technologies to increase productivity, reduce cycle times, and improve tool life and surface finish.

“High-feed milling is a great option in die/mold, to use as a roughing operation with solid-carbide, negative-geometry high-feed mills, clearing as much material as possible prior to semi-finishing and finishing with an HSM-style path,” OSG’s Dominski explained. “In aerospace, high-feed milling is most often used with titanium aircraft frame components, where solid or indexable high feed mills can make quick work of roughing.”

As the radial depth-of-cut decreases, the effective chip load declines, Dominski said. That means “chip thinning compensation must be applied so that the tool’s recommended chip load is being cut by each tooth,” he continued. “If this does not occur, you may actually rub the part, resulting in surface-finish issues.”

He also noted that, “in aluminum, high-feed machining would be a really good way to go because the material is easy to machine, and you can take heavy bites without worrying about engagement angle overloads, whereas in difficult-to-machine materials like superalloys, it’s important to take advantage of high-speed and particularly high-efficiency machining, utilizing trochoidal-style toolpaths wherever possible.”

Kip Hanson, who is the proprietor of KAHMCO LLC, has more than 40 years of experience in manufacturing, machine tools, fabrication and ERP systems. He contributed a version of this post to MSC Industrial Supply Co.’s Better MRO blog.

“Cutting tool demand is likely to show further softness in the second half of 2024, driven by widespread inventory liquidation in many industries,” explained Eli Lustgarten, president of ESL Consultants. “While there are pockets of strength in markets such as government-financed infrastructure and data centers, the farm equipment sector will show dramatically lower production in the second half of 2024. Energy, construction, and mining sector output will decline.

Daniel Dominski, technical sales engineer for OSG’s South Central and Southeast regions; Luke Pollock, senior global product manager for Indexable Milling at Kennametal; and Jacob Rak, an applications engineer responsible for research and development at Kyocera SGS Precision Tools, are familiar with the dilemma.

“Heightened uncertainty also exists in automotive and commercial aerospace markets,” the expert noted.

Nor is there a shortage of high-performance cutters, whether these are solid-carbide end mills boasting variable-helix angles, unequal flute spacing, or coatings that many experts only dreamed about a decade ago.

Luke Pollock and Jacob Rak agreed that the technique is very effective when clearing out a large pocket in a mold cavity, for example, or opening a cavity in a titanium aircraft component. Because the cutting forces are directed upward into the machine spindle where it’s strongest, even a less rigid machine can be used.

The technique is mostly utilized in the die and mold industry, “where materials are hard (35-65 HRC) and larger cuts are not possible,” Dominski said. “The machine tools used here are generally the most capable, as they have high accuracy and look-ahead capabilities, very responsive controls and servo systems, and are quite capable of the quick, precise movements needed in these applications.”

Manufacturers’ demand for cutting tools closely matches U.S. durable goods shipments as a measure of overall industrial activity, and according to an analyst cited by AMT the remainder of 2024 does not appear to result in increased manufacturing activity.

High-efficiency machining — which includes trochoidal-style toolpaths, dynamic milling, Volu-Milling, and all the rest — control the radial engagement angle “by making stepovers progressively smaller as the tool goes into corners and tighter areas,” according to Rak, of Kyocera SGS Precision Tools. “Here, the goal is to make the chip loading as consistent as possible.”

High-speed machining (HSM) is often defined as a milling technique that utilizes spindle speeds of 20,000 rpm or greater, and relatively small radial depths of cut (less than 25 percent of the cutter diameter.)

“While tempering our enthusiasm for the second half of 2024, expectations for cutting tool order growth are still very positive for 2025,” Boyer added.

Cutting tool purchases fell -2.9% in value from May to June 2024, totaling $208.1 million in the latest Cutting Tool Market Report issued by AMT - the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute. The June figure is also -4.2% lower than the June 2023 result, and it brings the January-June 2024 value for cutting tool purchases to $1.27 billion – which is still 2.6% higher than last year’s six-month total.

There’s no shortage of high-quality CAM solutions, almost all of them providing capabilities that fall under one or more of the umbrella terms high-speed, high-feed, and high-efficiency machining.

And those are only parts of the equation. Machining at these speeds requires cutters designed for extreme heat and efficient chip evacuation, as well as a machine tool with a motion-control system able to achieve commensurately higher feed rates, often in the face of rapidly changing toolpaths.

High-efficiency machining (HEM) is quite similar to high-speed machining in that it uses fairly high spindle speeds and feed rates, as well as a large axial depth-of-cut and small radial cut width. With high-efficiency machining however, more attention is paid to the end mill’s engagement angle and avoidance of “spikes” that can lead to chatter, tool wear, and even breakage.

USCTI and AMT’s monthly Cutting Tool Market Report, summarizes shipments made by companies who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable.

When it comes to selecting the right technique for a given application, there are several factors to consider. These include the type of material being machined, the part size and geometry, the desired surface finish, and the available machine tool and cutting tool technology.

18581906093

18581906093